When verifying card details online, knowing the card brand, like Visa or American Express, is critical. Whether you’re managing online payments, preventing fraud, or developing a fintech application, you need fast and reliable tools. That’s where MR Checker stands out. It provides instant, accurate card identification using only the first six digits (BIN/IIN) of the card number. But how good is it at specifically detecting Visa and American Express (Amex)?

With millions of transactions taking place online daily, it’s vital to ensure that tools like MR Checker can distinguish between major card brands efficiently. Fortunately, MR Checker’s BIN lookup tool is designed to deliver real-time results, making it incredibly helpful in separating Visa from Amex or other networks.

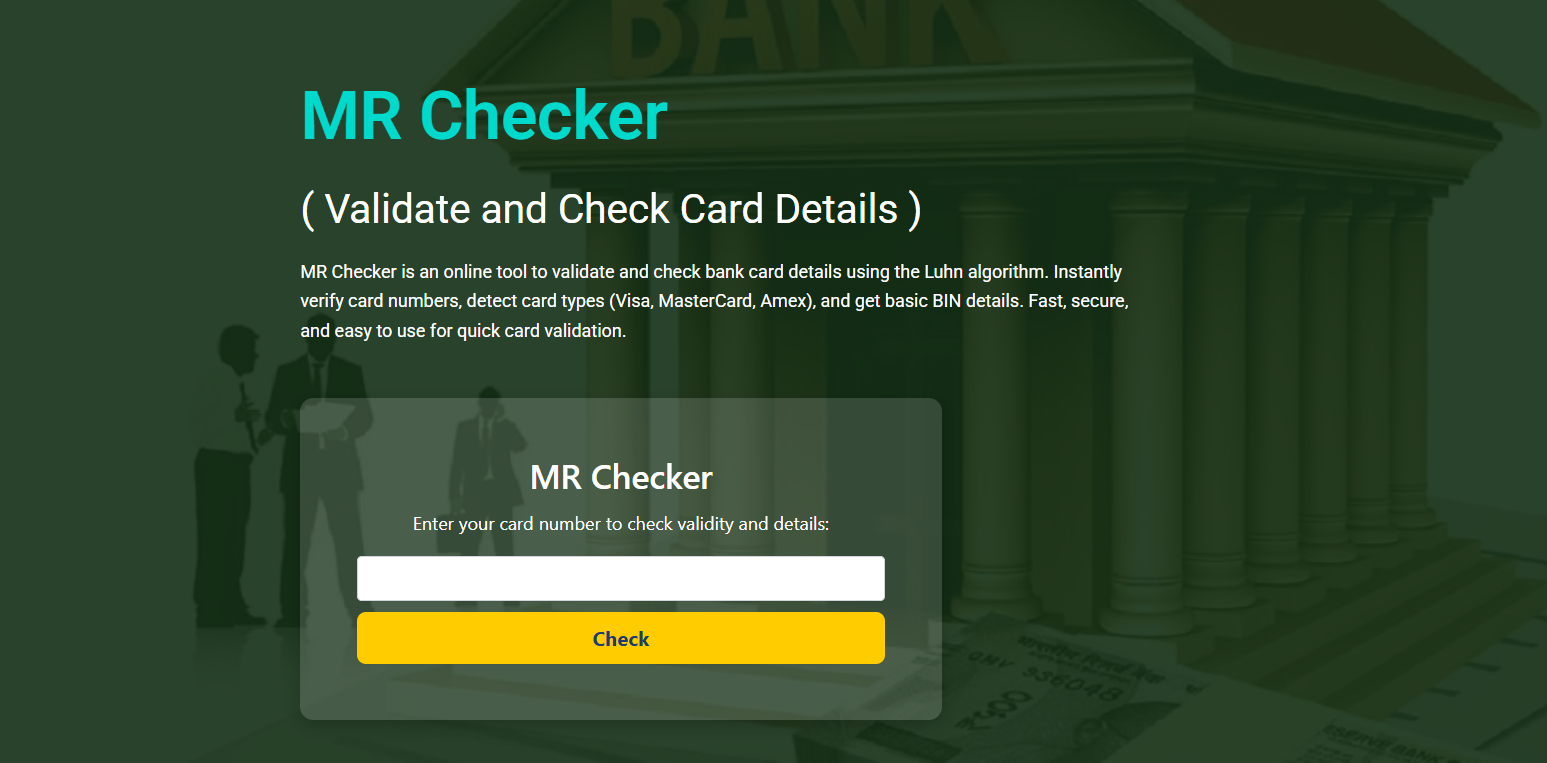

MR Checker Identify Card Brands

BIN-Based Detection

Every card begins with a Bank Identification Number (BIN), the first six digits of the card. MR Checker leverages this to instantly determine a card’s brand, such as Visa, MasterCard, Discover, or American Express.

Visa cards typically start with a 4, while American Express cards usually begin with 34 or 37. MR Checker analyzes this prefix and consults its internal BIN database to return results in seconds, providing a confident identification of the card brand.

Real-Time Processing

MR Checker doesn’t rely on outdated or cached data. It performs real-time BIN lookups every time a user submits a card number. That ensures even new or reissued cards are recognized based on up-to-date industry data. This accuracy is especially useful when dealing with global card variations, where patterns might change or expand.

The real-time aspect also means no delay; users get instant insight into whether a card is Visa, Amex, or another brand altogether.

Detailed Brand Output

When MR Checker processes a BIN, it doesn’t just say “Visa” or “Amex.” It provides a comprehensive card profile, including:

- Card brand (e.g., Visa, Amex)

- Card type (credit, debit, prepaid)

- Card level (Classic, Gold, Platinum)

- Issuing bank

- Country of origin

This level of detail confirms not only the brand but also the authenticity of the card and the issuer behind it.

Detecting Visa Cards with MR Checker

Instant Brand Confirmation

MR Checker immediately identifies Visa cards once a valid BIN is entered. The tool detects the starting digit “4” and confirms Visa as the brand within seconds. It also reveals whether the card is a Visa Classic, Visa Gold, or Visa Electron, providing added specificity.

This makes MR Checker ideal for:

- E-commerce stores confirming legitimate payments

- Payment processors verifying card brands

- Developers testing Visa-based checkout flows

Bank and Country Accuracy

MR Checker can pinpoint which bank issued the Visa card and from which country. Whether it’s a Visa debit card from the US or a Visa credit card from the UK, the results are accurate and region-specific. This is crucial for international businesses processing payments globally.

By knowing the exact issuer and location, users can detect anomalies like a Visa card from an unexpected country, which might indicate fraud.

Works for All Visa Variants

Visa offers multiple product lines, including:

- Visa Credit

- Visa Debit

- Visa Electron

- Visa Business

MR Checker recognizes all of them. Its internal logic maps the BIN directly to the correct Visa variant, leaving no room for confusion. This universal Visa detection is especially helpful in corporate environments and merchant systems.

Detecting American Express (Amex) Cards with MR Checker

Specialized BIN Patterns

American Express has a unique structure. Most Amex cards begin with 34 or 37, and they often have 15 digits (unlike the 16 digits used by Visa or MasterCard). MR Checker recognizes these identifiers immediately and displays American Express as the brand with pinpoint accuracy.

For those dealing with high-value or international transactions—where Amex is common—this brand detection is vital.

Corporate vs. Personal Amex Cards

Amex issues different types of cards for different audiences. MR Checker detects whether the card is a:

- Personal American Express card

- Business Amex

- Amex charge card

- Amex prepaid card

This classification adds context to the card’s purpose and use case. For example, a merchant dealing with a corporate Amex card may have different processing rules than for a personal one. MR Checker simplifies that decision-making.

Detecting Amex by Country

Amex cards are used worldwide, but their availability and rules vary by country. MR Checker’s BIN lookup identifies the card’s country of origin, allowing users to verify that a U.S.-issued Amex card is being used in an appropriate location—or to flag suspicious activity when it’s not.

This global scope makes MR Checker especially useful for international brands or online platforms with global customer bases.

Why Visa and Amex Detection Matters

Preventing Fraud

Visa and Amex are among the most widely used card brands, making them frequent targets for carding fraud. By detecting the brand, issuer, and country, MR Checker helps users:

- Confirm legitimate transactions

- Flag high-risk cards

- Detect mismatches between card data and user location

Fraud prevention teams can integrate MR Checker into their review process to reduce chargebacks and financial risk.

E-Commerce and Payment Gateways

Knowing whether a card is Visa or Amex helps online businesses in routing payments, applying the right processing fees, and enforcing transaction rules. MR Checker provides this intelligence instantly, so store owners and developers can make decisions without delays.

Certain promotions or discounts may apply to Visa but not Amex—or vice versa. With real-time brand detection, businesses can enforce brand-specific logic dynamically.

API Integration for Developers

Though MR Checker’s frontend is web-based, many developers use its output logic for internal tools or as a reference. When testing new payment systems or verifying cards during QA phases, they rely on MR Checker to:

- Simulate Visa or Amex card behavior

- Detect correct formatting

- Confirm brand-specific validation processes

Its ability to reliably identify brand-specific BINs makes it an essential tool in fintech development and payment infrastructure.

Visa vs. Amex

High Match Rates

MR Checker maintains a verified BIN database, updated regularly. For both Visa and Amex, the tool boasts a high match rate, meaning the returned brand and bank information align with known financial data. This minimizes false positives and ensures users are working with real, verifiable card details.

Whether you’re testing one BIN or reviewing hundreds, MR Checker consistently returns correct brand data for both Visa and Amex.

Speed and Consistency

The tool delivers instant results, typically in less than a second. This responsiveness is key in situations where decisions must be made quickly, like in fraud detection, customer service, or automated scripts.

You can enter multiple card BINs, and MR Checker will return consistent and reliable brand detections every time. Its performance is on par with premium paid services.

No Login or Restrictions

Many BIN lookup tools limit access to Visa or Amex details unless you register or pay. MR Checker doesn’t. It offers full brand recognition including Visa and Amex without requiring sign-ups or fees. This makes it accessible to everyone, from casual users to professionals.

Its open-access nature, combined with high accuracy, positions it as a leading free BIN lookup solution for card brand detection.

Benefits from Visa and Amex Detection

Online Sellers

Store owners can detect the card type at checkout and decide whether to accept or decline based on business rules. Amex, for example, often has higher transaction fees, so sellers might want to exclude it from certain promotions.

Knowing the card brand also helps determine risk factors associated with international payments.

Security Teams

Teams focused on payment security can use MR Checker to cross-reference card brands with IP addresses, shipping countries, or user profiles. Detecting that a card brand doesn’t match other data points is often the first clue in uncovering fraud.

MR Checker acts as a silent partner in this process, instantly surfacing brand and issuer insights.

Developers and Testers

Whether building a payment platform or testing a card validation form, developers need real-time card brand detection. MR Checker provides a free and reliable way to simulate and test Visa or Amex detection in a controlled environment.

Key Advantages of MR Checker for Visa & Amex

- No registration required

- Accurate brand and issuer details

- Real-time BIN matching

- Detects all Visa and Amex variations

- Consistent, fast results

- Updated BIN database

- Usable by individuals, businesses, and developers

These benefits make MR Checker one of the most versatile and accurate tools for detecting Visa and Amex BINs on the market today.

Conclusion

Yes, you can absolutely use MR Checker to detect Visa and American Express cards with speed and accuracy. It delivers real-time, verified results without requiring login or payment making it a trustworthy tool for developers, businesses, and individuals alike. With complete BIN insights, including brand, issuer, and country, MR Checker allows you to instantly confirm whether a card belongs to Visa or Amex, helping prevent fraud, streamline payments, and support secure transactions across platforms.