Artificial Intelligence (AI) is no longer a futuristic concept—it has become an essential driver of efficiency, scalability, and accuracy in enterprise finance. From automating repetitive tasks to providing predictive insights, AI is reshaping how organizations manage budgets, capital expenditures, and day-to-day expenses. As businesses face increasing pressure to optimize costs and improve decision-making, AI-powered platforms like AI in project and capital expenditure management and intelligent expense management agents are proving to be game-changers.

In this article, we explore how AI is redefining project management and expense oversight, the benefits it brings to finance teams, and why enterprises are adopting AI-driven solutions for sustainable growth.

The Role of AI in Modern Finance

Finance functions have traditionally been burdened with manual processes—spreadsheets for budgeting, labor-intensive approval cycles, and time-consuming reconciliations. AI changes this paradigm by introducing:

- Automation of repetitive tasks such as invoice processing, expense approvals, and reporting.

- Predictive analytics to forecast spending trends and optimize capital allocation.

- Enhanced compliance by ensuring adherence to financial policies and regulatory requirements.

- Real-time insights to improve agility in decision-making.

These capabilities enable finance teams to shift their focus from administrative workloads to strategic contributions.

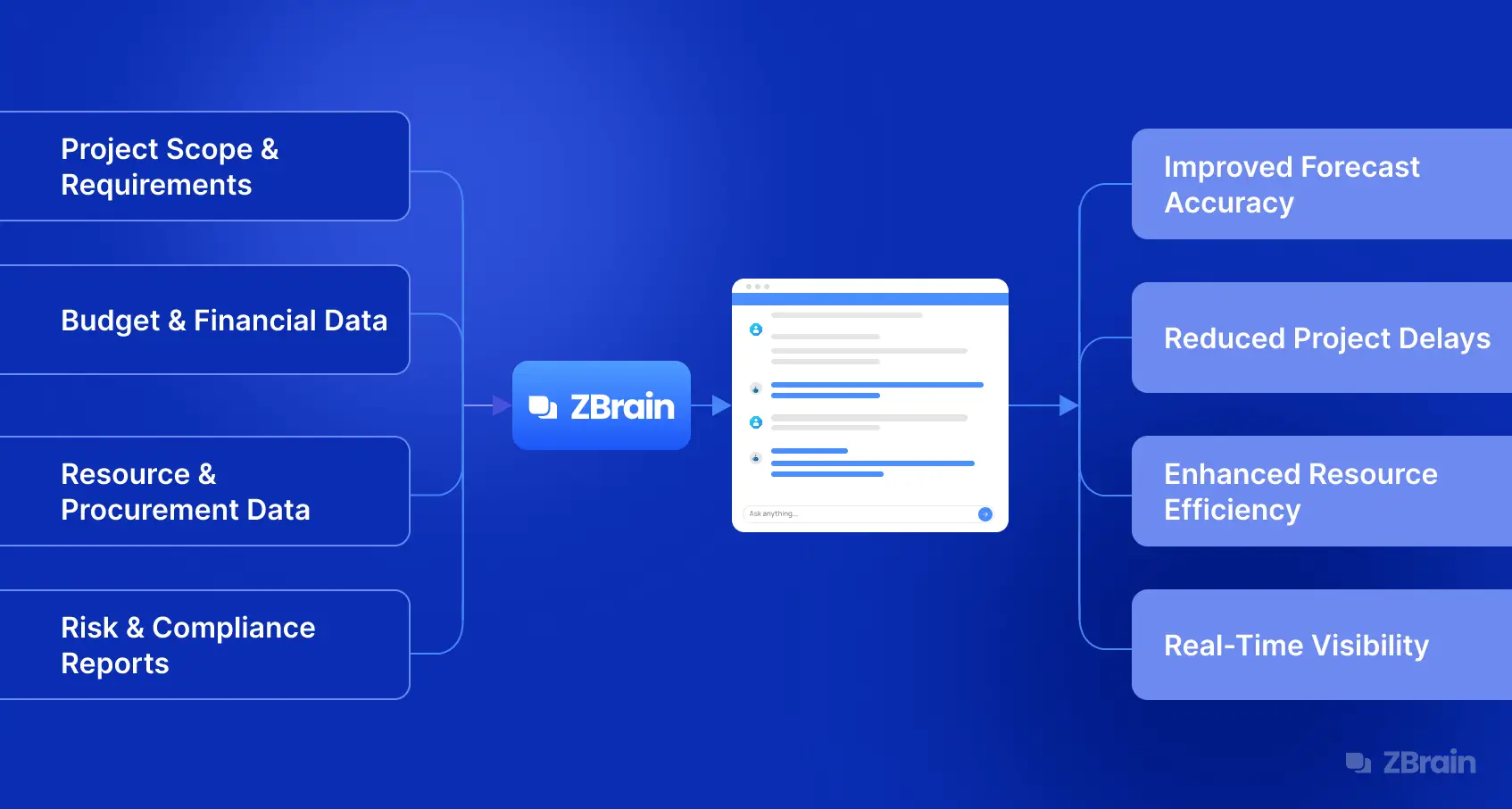

AI in Project and Capital Expenditure Management

Improving Capital Allocation

Effective project and capital expenditure (CapEx) management is critical for ensuring that resources are invested in the right initiatives. With AI-driven platforms, finance leaders can analyze vast datasets, assess project feasibility, and predict long-term returns with greater accuracy.

Enhancing Forecasting and Budgeting

AI models can continuously learn from historical data and external market conditions. This enables dynamic budgeting, where forecasts are automatically updated based on changing inputs. By leveraging solutions for AI in project and capital expenditure management, organizations can minimize budget overruns and improve project success rates.

Risk Mitigation

AI-powered monitoring systems detect anomalies in spending patterns, flagging potential risks before they escalate. This ensures that financial discipline is maintained while supporting agile decision-making.

AI in Expense Management

Streamlining Expense Processing

Traditional expense management involves manual submissions, reviews, and audits—prone to errors and delays. AI automates these processes by extracting information from receipts, categorizing expenses, and validating them against company policies.

Ensuring Policy Compliance

Finance teams often struggle with enforcing policies across global operations. With AI, compliance becomes automated, ensuring employees follow organizational guidelines. The expense management agent simplifies this by integrating policy checks directly into the approval workflow.

Real-Time Reporting and Insights

Instead of waiting for month-end reports, AI delivers instant visibility into expense data. This empowers finance leaders to monitor spending in real-time, identify cost-saving opportunities, and make proactive adjustments.

Key Benefits of AI Adoption in Finance

Increased Efficiency

By eliminating repetitive manual work, AI allows finance professionals to focus on high-value tasks such as strategic planning and business growth initiatives.

Cost Optimization

AI identifies inefficiencies, reduces fraud risks, and ensures optimal allocation of funds—helping organizations achieve significant cost savings.

Improved Accuracy

Machine learning models reduce human error in processes such as invoice matching, forecasting, and budget tracking.

Enhanced Employee Experience

Employees benefit from faster expense reimbursements and simplified submission processes, reducing frustration and administrative burden.

Best Practices for Implementing AI in Finance

Start with High-Impact Use Cases

Organizations should begin with areas that deliver measurable ROI, such as automating expense approvals or improving CapEx forecasting.

Ensure Data Quality

AI relies on accurate data for meaningful outputs. Investing in data cleansing and governance is essential for reliable insights.

Integrate with Existing Systems

Seamless integration with ERP, HR, and procurement systems ensures smooth workflows and reduces disruption.

Focus on Change Management

Employees must be educated on the benefits of AI adoption to overcome resistance and encourage adoption.

The Future of AI in Finance

The next wave of AI in finance will focus on autonomous decision-making and predictive planning. Instead of merely supporting finance teams, AI will recommend optimal actions, manage risks proactively, and continuously optimize cash flows. As AI agents become more sophisticated, finance departments will evolve into strategic powerhouses driving business transformation.

Conclusion

AI is no longer optional for enterprises—it is the foundation of modern financial management. From improving project oversight to transforming expense tracking, AI solutions are empowering organizations to achieve efficiency, accuracy, and agility. By leveraging platforms for AI in project and capital expenditure management and deploying intelligent tools like the expense management agent, businesses can future-proof their finance functions and unlock long-term growth.